You can pay your dues at maplelakepropertyowners.com/pay-your-dues with confidence. We have partnered with Authorize.Net www.authorize.net, a leading payment gateway since 1996, to accept credit cards and electronic payments safely and securely for our members.

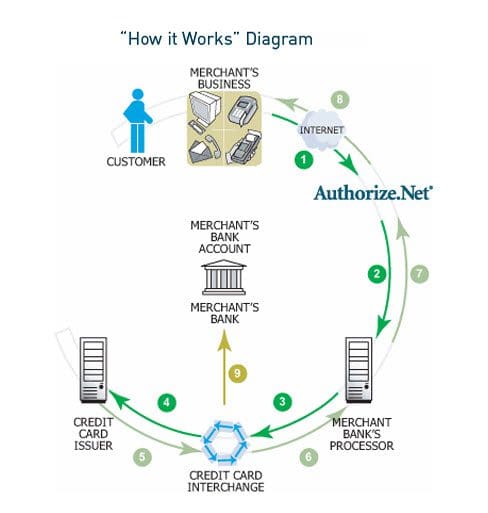

The Authorize.Net Payment Gateway manages the complex routing of sensitive customer information through credit card processing networks. See an online payments diagram to see how it works.

The company adheres to strict industry standards for payment processing, including:

-

128-bit Secure Sockets Layer (SSL) technology for secure Internet Protocol (IP) transactions.

-

Industry-leading encryption hardware and software methods and security protocols to protect customer information.

-

Compliance with the Payment Card Industry Data Security Standard (PCI DSS).

For additional information regarding the privacy of your sensitive cardholder data, please read the Authorize.Net Privacy Policy.

maplelakepropertyowners.com is registered with the Authorize.Net Verified Merchant Seal program.

View a step-by-step process of how Authorize.Net processes payments securely below.

- The merchant submits a credit card transaction to the Authorize.Net Payment Gateway on behalf of

a customer via a secure connection from a Website, at retail, from a MOTO center, or a wireless

device. - Authorize.Net receives the secure transaction information and passes it via a secure connection to

the Merchant Bank’s Processor. - The Merchant Bank’s Processor submits the transaction to the Credit Card Interchange (a network

of financial entities that communicate to manage the processing, clearing, and settlement of credit

card transactions). - The Credit Card Interchange routes the transaction to the customer’s Credit Card Issuer.

- The Credit Card Issuer approves or declines the transaction based on the customer’s available funds

and passes the transaction results, and if approved, the appropriate funds back through the Credit

Card Interchange. - The Credit Card Interchange relays the transaction results to the Merchant Bank’s Processor.

- The Merchant Bank’s Processor relays the transaction results to Authorize.Net.

- Authorize.Net stores the transaction results and sends them to the customer and/or the merchant.

This communication process averages three seconds or less! - The Credit Card Interchange passes the appropriate funds for the transaction to the Merchant’s

Bank, which then deposits funds into the merchant’s bank account.